Creating Value – Maximizing Opportunity

others have entered into alliances with third parties to provide such

services. (McKinsey Quarterly)

If value creation is the name of the game in business, then maximizing the exit opportunity is how championships are won. Maximum opportunity comes from having a laser focus on value creation throughout the entire investment relationship and developing a strategy to position the portfolio company to enter its next round of value creation potential for a subsequent buyer to harvest.

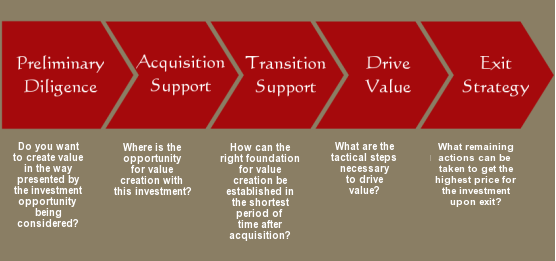

The Maximum Opportunity Model™ provides a framework for The RobinsonEdwards Group to partner with private equity firms and their portfolio companies to maximize their exit opportunities by deliberately and aggressively driving value from preliminary diligence through exit.

There are five distinct phases to the model that require a strategic focus to be applied in unique ways. There is a key value creation question that drives the strategic activities of each phase.

Click the links on the right to learn more about each phase, its anticipated benefits, and the general approach.